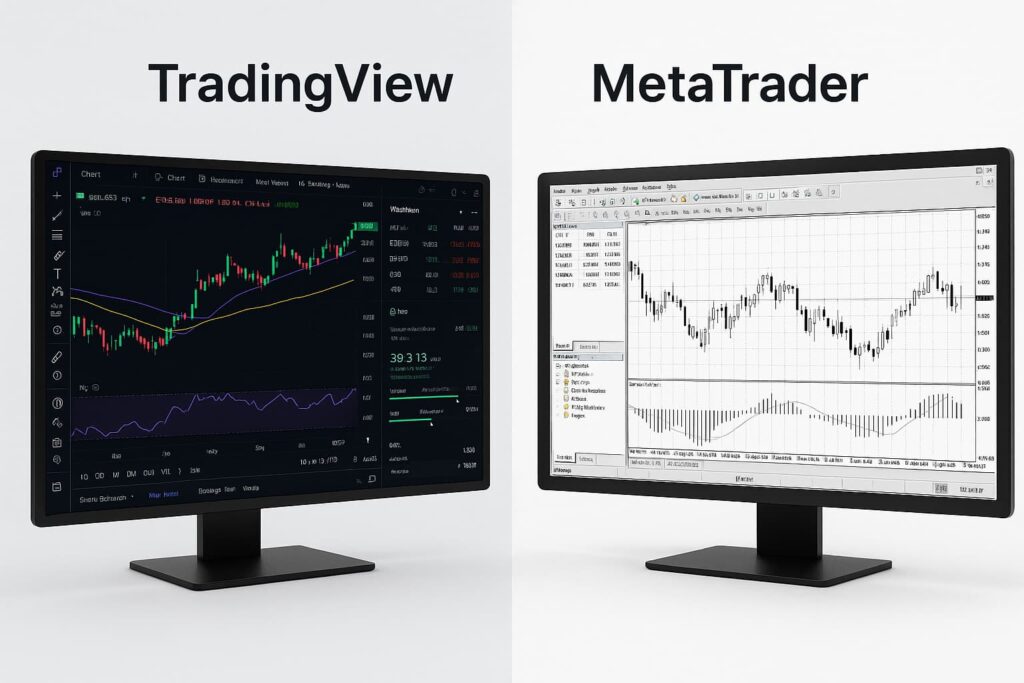

Side-by-side feature breakdown: TradingView vs MetaTrader in 2025

When it comes to powerful charting and real-time market analysis, two names dominate the conversation: TradingView vs MetaTrader. Whether you’re a stock trader, crypto analyst, or forex enthusiast, choosing the right platform can mean the difference between clarity and confusion — and ultimately, between profit and loss.

In this article, we’ll break down the key differences, performance, features, and why more modern traders are choosing TradingView over MetaTrader in 2025.

Side-by-Side Comparison: TradingView vs MetaTrader

| Feature | TradingView | MetaTrader 4/5 |

|---|---|---|

| Platform Type | Web-based (no install needed) | Desktop-first (requires installation) |

| User Interface | Clean, modern, intuitive | Outdated, technical, less user-friendly |

| Asset Support | Stocks, crypto, forex, indices, futures | Primarily forex + CFDs |

| Broker Integration | Fewer native brokers, but expanding | Wide broker support (especially forex) |

| Charting Tools | 100+ indicators, custom scripts, Pine Script | Basic indicators + MQL4/MQL5 scripting |

| Community Sharing | Massive community with shared scripts/charts | Minimal social integration |

| Mobile App | Highly rated iOS/Android app | Functional but dated |

| Backtesting | Built-in strategy tester | Available via custom code |

| Ease of Use | Beginner-friendly | Steep learning curve |

| Pricing | Free + Paid tiers ($14.95+/mo) | Free via brokers, but less flexibility |

1. User Interface and Accessibility

TradingView vs MetaTrader isn’t just a matter of features it starts with first impressions. TradingView runs entirely in your browser. There’s no software to install, and the interface is built for modern devices. In contrast, MetaTrader still feels like legacy software from a decade ago.

Most new traders find TradingView’s clean UI far easier to navigate. You can start plotting your first trade ideas within minutes, even as a beginner.

2. Cross-Asset Support and Chart Variety

Another reason traders prefer TradingView vs MetaTrader is its broad support for different markets. TradingView allows analysis across stocks, crypto, forex, commodities, indices, and even bonds — all from a single platform.

MetaTrader, especially MT4, is mostly limited to forex and CFD markets. If you’re a multi-asset trader or follow multiple sectors, TradingView wins without contest.

3. Charting Tools and Technical Indicators

TradingView offers some of the most advanced charting tools available:

- 100+ built-in indicators

- Volume profile, heat maps, and market internals

- Pine Script for custom strategies

MetaTrader does support custom indicators via MQL4/5, but it lacks the native flexibility and speed of TradingView’s drag-and-drop system.

TradingView vs MetaTrader in 2025 boils down to flexibility — TradingView makes it easy to test, tweak, and visualize trades.

4. Social Sharing and Strategy Discovery

One of TradingView’s greatest advantages is its community-powered ecosystem. Thousands of public scripts, strategy ideas, and analyst charts are shared daily.

With TradingView vs MetaTrader, only one platform functions like a social network for traders. MetaTrader doesn’t offer anything close to this kind of public collaboration. That’s a major loss for beginner and intermediate traders trying to learn fast.

5. Automation and Scripting

TradingView uses Pine Script, which is simple and fast to learn. You can automate signals, build custom alerts, and even run backtests in a few lines of code.

MetaTrader’s MQL4/MQL5 is more powerful in terms of automated trading (especially on MT5), but it has a steeper learning curve. Unless you’re a developer or use bots full-time, TradingView’s scripting is more accessible.

In the TradingView vs MetaTrader debate, Pine Script lowers the entry barrier significantly.

6. Broker Connectivity

MetaTrader remains strong when it comes to broker integration, particularly for forex traders. Dozens of brokers use MetaTrader as their core platform, and orders can be routed directly through it.

TradingView is improving here — they’ve added support for brokers like TradeStation, OANDA, and others — but the list is smaller for now. However, many traders use TradingView for analysis and execute trades through other apps.

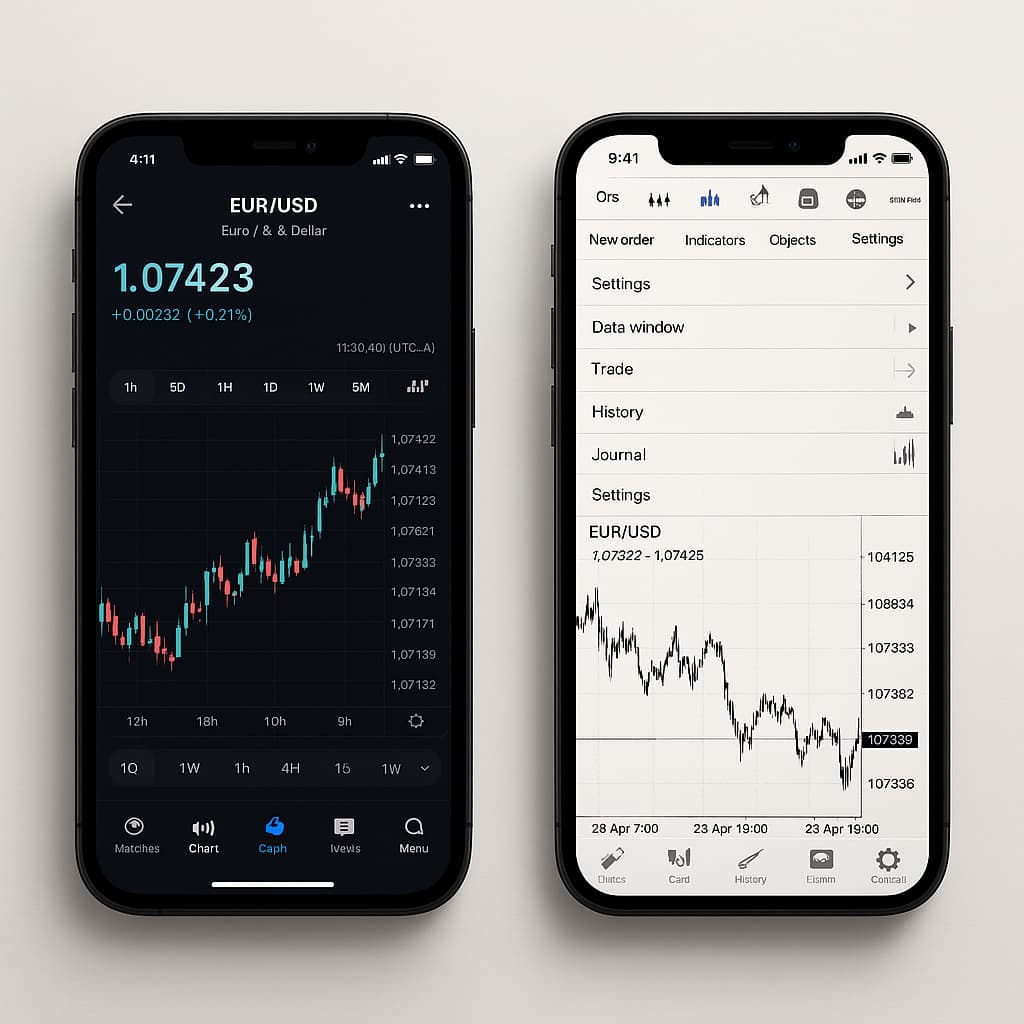

7. Mobile Trading Experience

In 2025, mobile trading is no longer optional. TradingView’s app is fast, sleek, and syncs across devices instantly. MetaTrader’s mobile version works, but hasn’t seen major innovation in years.

That makes a difference when you’re trading on the go — another point in favor of TradingView vs MetaTrader.

8. Pricing: What Do You Get for Free?

MetaTrader is technically free — but that’s because brokers fund the platform. You often trade with wider spreads or limited tools unless you pay elsewhere.

TradingView offers a free tier, but the Pro and Premium plans unlock massive value. Real-time data, unlimited indicators, multiple chart layouts, and priority support are standard.

👉 Want to try the premium features?

Start your free trial of TradingView Pro

9. Trader Types: Who Should Use What?

| Trader Type | Best Fit | Why |

|---|---|---|

| Beginner Retail Trader | TradingView | Simpler, easier learning curve |

| Forex Specialist | MetaTrader | More native broker options |

| Multi-Asset Investor | TradingView | Broader charting + asset access |

| Algo Developer / Bot Trader | MetaTrader (MT5) | Deep automation support |

| Swing / Technical Analyst | TradingView | Best-in-class visual tools |

Final Verdict: TradingView vs MetaTrader in 2025

While both platforms have their place, TradingView outshines MetaTrader in most modern trading scenarios. If you’re focused on clean UI, flexible charts, and multi-asset support, TradingView is the clear winner. It’s built for modern traders — fast, mobile, and visually intuitive.

MetaTrader still holds ground for serious forex algorithmic traders, but for most retail and hybrid investors, the choice is clear.

🎯 Ready to experience the TradingView advantage?

Start your free trial of TradingView Pro here

Frequently Asked Questions

Is TradingView better than MetaTrader for beginners?

Yes. TradingView is browser-based, easier to navigate, and doesn’t require downloads or complex setups.

Can I trade directly on TradingView?

Yes TradingView supports direct trading through select brokers (e.g., OANDA, TradeStation), with more integrations being added.

Is MetaTrader still useful in 2025?

For forex and algorithmic trading, yes. But for most modern retail traders, TradingView vs MetaTrader is an upgrade worth making.