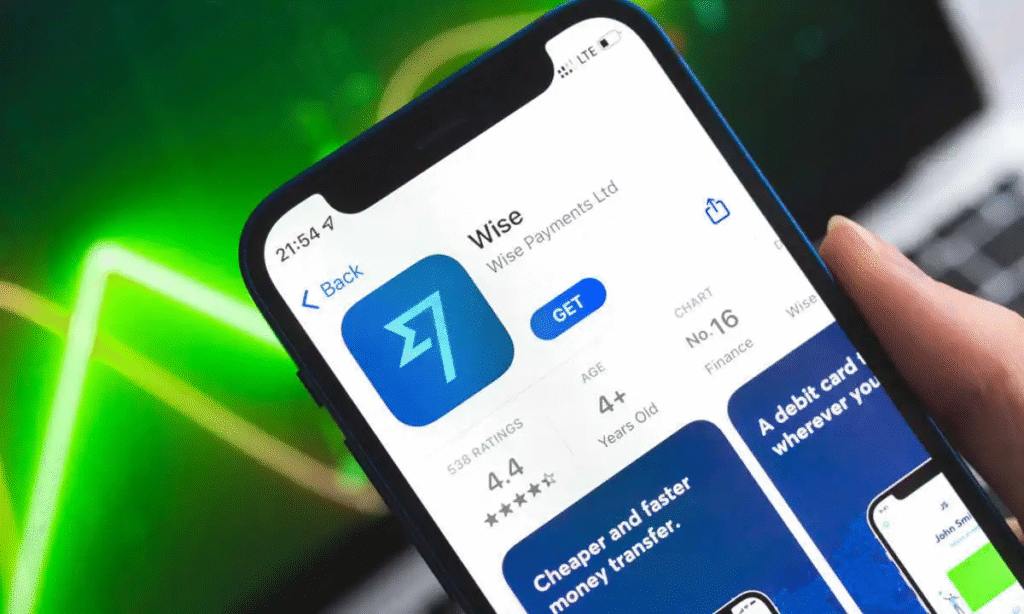

Wise Review by NomadsAnalytics Trusted finance tool for freelancers and global creators.

Sending money across borders has always been a challenge slow, expensive, and full of hidden fees. Traditional banks and outdated remittance services rarely offer full transparency. That’s where Wise money transfers step in, revolutionizing global finance with fairness and clarity.

Founded in 2011 (formerly TransferWise), Wise has grown into a trusted financial technology company used by over 16 million customers worldwide. This article explores how Wise money transfers work, why they’re better than banks, and how you can save time and money with every transaction.

What Makes Wise Different?

Wise money transfers are built on one goal: making international payments as cheap and transparent as possible. Here’s how Wise does that:

- Real Exchange Rates: Wise uses the mid-market rate (the one you see on Google), with no markups.

- Low, Transparent Fees: You see upfront exactly how much you’ll pay.

- Speed: 45% of transfers arrive instantly, 80% within 24 hours.

- Multi-currency Account: Hold 40+ currencies and spend with the Wise debit card.

People also read

- What Is Crypto Tax Software and Why You Need CoinLedger in 2025

- Buy a .com Domain in 2025: Still the Smartest Move for Your Brand

- Why Prop Firms Forex Like FTMO Are a Game-Changer

🔗 Wise official FAQ explains how they operate under global regulations while maintaining low fees.

💸 How Wise Money Transfers Work

Let’s break it down step-by-step:

- You send money to Wise in your local currency.

- Wise converts it using the real exchange rate.

- Wise pays out the amount in the recipient’s currency from their local account in that country.

Unlike banks, which use SWIFT and middlemen, Wise money transfers avoid costly international fees by operating local accounts in each country. This makes transfers faster and more cost-effective.

🧮 Wise vs Traditional Banks: The Real Savings

A 2024 comparison by NerdWallet showed that Wise money transfers were up to 8x cheaper than major banks.

| Feature | Wise | Traditional Banks |

|---|---|---|

| Exchange Rate Markup | 0% (mid-market rate) | 3–5% hidden fee |

| Transfer Fee | Fixed + %, shown | Often vague or tiered |

| Transfer Speed | 1 day average | 3–7 days |

| Transparency | 100% clear | Often hidden or confusing |

You can sign up and try their real-time calculator to compare costs with any bank.

📱 The Wise App Experience

Managing money on-the-go is easy with the Wise mobile app, available on iOS and Android. You can:

- Track every Wise money transfer

- Hold multiple currencies

- Send or request money with a link

- Get real-time alerts

With over 4.5 stars on Google Play and the App Store, users praise the app for simplicity and reliability.

✅ Who Should Use Wise?

Whether you’re a freelancer, digital nomad, small business owner, or someone supporting family abroad, Wise money transfers are ideal for:

- Remote workers getting paid in USD, EUR, or GBP

- E-commerce sellers withdrawing from platforms like Shopify or Amazon

- Travelers and expats needing affordable money conversion

- Businesses paying international invoices

According to Wise, over 300,000 businesses actively use the platform every month.

Regulatory Approval and Safety

Wise is regulated by top-tier institutions globally, including:

- Financial Conduct Authority (FCA) – UK

- FinCEN – USA

- ASIC – Australia

- MAS – Singapore

This ensures your Wise money transfers are secure and compliant with anti-money laundering (AML) and Know Your Customer (KYC) rules.

More about safety on Wise’s official security page.

Fees Breakdown – What You Actually Pay

Wise’s fee model is a combination of:

- A fixed fee (e.g., $1.50 for USD)

- A percentage of the amount (usually between 0.35%–1.5%)

For instance, sending $1,000 USD to GBP may cost you under $10 total still far lower than most bank fees. And there are no fees for receiving money into your Wise account.

You can check their full pricing guide here.

Supported Countries and Currencies

Wise currently supports:

- Transfers to 160+ countries

- Currency balances in 50+ currencies

- Local bank details for 10 currencies (USD, EUR, GBP, AUD, CAD, etc.)

Whether you’re sending money to Kenya, Germany, or Brazil, Wise money transfers are one of the few services offering real-time local delivery to bank accounts and mobile wallets.

Open Wise Account hereExpert Insights

Here’s what the experts say:

“Wise is the best option for international transfers if you want transparency and low fees.”

– Investopedia, 2025

“Compared to banks, Wise saves users both time and money.”

– Forbes Money

These reviews echo what many individual users and financial bloggers already know Wise money transfers are reliable, cost-efficient, and fast.

Customer Testimonials

Here are a few authentic testimonials pulled from Trustpilot (4.4/5 rating):

💬 “I send money to my parents in Ghana every month. With Wise money transfers, I save over $40 compared to my old bank.”

💬 “Running my eBay store from South Africa used to be tough Wise changed that. Now I withdraw USD weekly.”

💬 “I’m a digital nomad. Wise lets me hold and switch currencies wherever I go no fuss.”

Things to Know Before Using Wise

While the benefits are many, keep in mind:

- Cash pickup is not supported — Wise sends directly to bank accounts or mobile wallets.

- Some countries have strict KYC rules, meaning longer verification.

- Transfers may be delayed due to public holidays or local banking hours.

Still, for most users, Wise money transfers offer consistent, fair service even when transferring large amounts internationally.

Final Thoughts

If you’re tired of excessive fees, slow transactions, and murky exchange rates, then it’s time to consider switching to Wise money transfers. Backed by millions of users, world-class tech, and strong regulatory oversight, Wise is redefining global payments.

Open Wise Account excperience seamless transactionsIn a world that’s going borderless, your money transfers should be too.