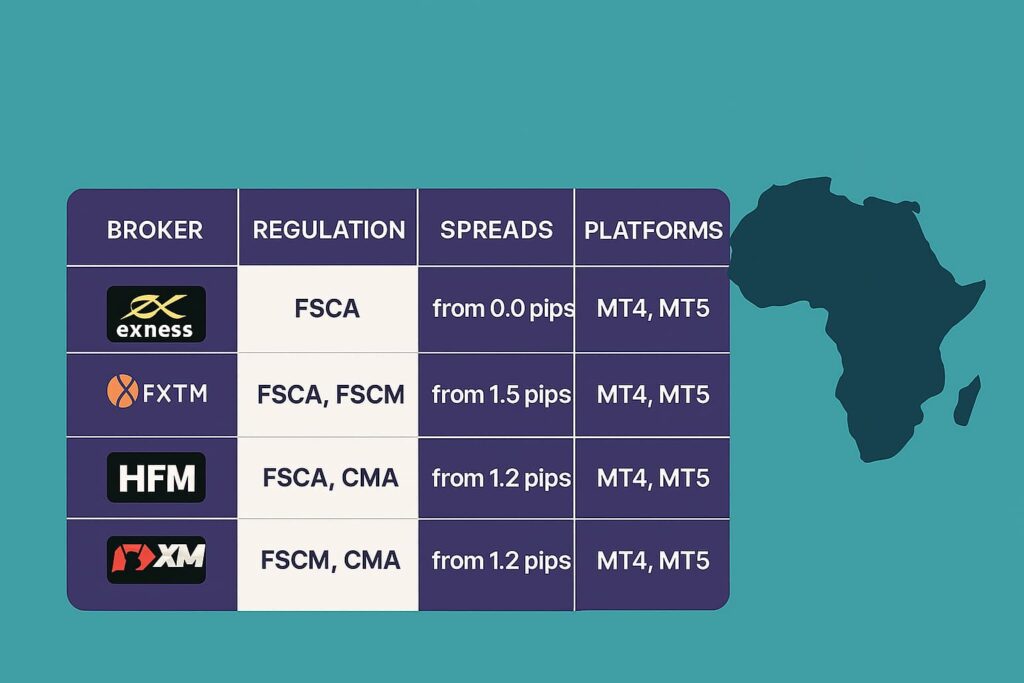

Visual comparison of the best regulated forex brokers in Africa for 2025, including spreads, platforms, and licensing bodies.

Forex trading is booming across Africa, but finding the best regulated forex brokers in Africa is essential if you want to trade safely and profitably. With the rise of scams and unlicensed platforms, regulation is the number one factor every African trader should consider.

This guide ranks the top 10 fully regulated forex brokers that cater to African traders, based on factors like licensing, trading fees, platform usability, deposit/withdrawal speed, and local support.

Whether you’re in Nigeria, Kenya, South Africa, or Rwanda, you’ll find a broker that suits your needs.

Table of Contents

1. Why Regulation Matters in Forex Trading

The forex market is decentralized, which means there’s no central authority governing all trades. That’s why dealing with regulated brokers is critical. When you use a broker that’s licensed by a top-tier financial authority, you get:

- Protection of funds (segregated accounts)

- Fair execution of trades

- Access to legal recourse

- Assurance of transparent operations

In Africa, many traders are targeted by offshore or unlicensed brokers. This guide highlights only the best regulated forex brokers in Africa that offer real protections.

2. Key Criteria for Choosing a Broker in Africa

Here’s what African traders should look for when choosing a regulated broker:

- Licensing: FCA, CySEC, FSCA, CMA, or other credible regulatory bodies

- Low spreads and commissions

- Fast withdrawals in local currency

- Mobile-friendly platforms

- Educational resources

- Local support and payment methods

3. Top 10 Best Regulated Forex Brokers in Africa

Here’s our 2025 list of the best regulated forex brokers in Africa:

1. Exness

- Regulation: FSCA (South Africa), FSA (Seychelles)

- Strength: Ultra-low spreads, instant withdrawals

2. FXTM (ForexTime)

- Regulation: FSCA, FCA, CySEC

- Strength: Strong presence in Nigeria and Kenya

3. Deriv

- Regulation: MFSA, LFSA, BVI FSC

- Strength: Fixed spreads, easy account setup

4. HotForex (HFM)

- Regulation: FSCA, FCA, CySEC

- Strength: Low minimum deposit, MT4/MT5 access

5. XM

- Regulation: CySEC, ASIC, IFSC

- Strength: Great for beginners, strong education

6. OctaFX

- Regulation: CySEC

- Strength: No commission, low spreads

7. IC Markets

- Regulation: ASIC, CySEC

- Strength: Best ECN execution, fast order speeds

8. AvaTrade

- Regulation: FSCA, ASIC, Central Bank of Ireland

- Strength: Regulated in over 6 jurisdictions

9. FP Markets

- Regulation: ASIC, CySEC

- Strength: Tight spreads, raw pricing model

10. Pepperstone

- Regulation: ASIC, FCA, DFSA

- Strength: Great for high-volume traders

4. Broker Comparison Table

| Broker | Regulation | Min Deposit | Spread Type | Platform | Local Support |

|---|---|---|---|---|---|

| Exness | FSCA, FSA | $10 | Floating | MT4/MT5 | Yes |

| FXTM | FSCA, FCA | $10 | Floating | MT4/MT5 | Yes |

| Deriv | MFSA, BVI | $5 | Fixed | DTrader | Yes |

| HotForex | FSCA, FCA | $5 | Floating | MT4/MT5 | Yes |

| XM | CySEC, ASIC | $5 | Floating | MT4/MT5 | Yes |

| OctaFX | CySEC | $25 | Floating | MT4/MT5 | Yes |

| IC Markets | ASIC | $200 | Raw/ECN | MT4/MT5 | No |

| AvaTrade | FSCA, ASIC | $100 | Fixed | AvaTradeGo | Yes |

| FP Markets | ASIC | $100 | Raw | MT4/MT5 | No |

| Pepperstone | ASIC, FCA | $200 | ECN | MT4/MT5 | No |

5. How to Verify a Broker’s License

Before signing up with any broker, always verify their license:

- Visit the regulator’s website (e.g., FSCA)

- Use the broker’s registration number (usually listed on their website)

- Cross-check their license status, expiry, and permitted operations

6. Tips for Safe Forex Trading in Africa

- Avoid brokers without clear regulation

- Never deposit money into personal accounts

- Use demo accounts before going live

- Withdraw small amounts to test processing speed

- Read broker reviews and forum feedback

🔥 Free Domain + Hosting from $2.99/mo

- 🌐 Free Domain Included

- 💰 Just $2.99/month

- ⚡ Fast, Reliable & Secure

7. FAQs

Q: Are these brokers legal in Nigeria or Kenya?

Yes, most are licensed to operate or recognized under local regulatory frameworks like FSCA or CMA.

Q: Which broker is best for beginners in Africa?

XM and FXTM offer great educational resources and low deposit options.

Q: Can I deposit using mobile money?

Yes. Exness, FXTM, and Deriv support mobile payments in Kenya, Nigeria, Rwanda, and more.

Q: Do these brokers offer Islamic accounts?

Yes. Most support swap-free (Islamic) accounts on request.

8. Final Thoughts

Choosing among the best regulated forex brokers in Africa comes down to your trading style, country of residence, and platform preferences.

- For low spreads and pro tools, try IC Markets or Exness.

- For local support and easy setup, go with Deriv or HotForex.

- For strong regulation, consider AvaTrade or XM.

Whichever broker you pick, always prioritize regulation, transparency, and customer support.